💳 Bank of America: Cards and Rewards

I used to think Bank of America wasn’t even in the conversation when it came to the best rewards cards. However, after digging in and now holding five BoA cards between my wife and me, I’ve realized they might actually have the strongest cashback lineup out there.

In this post, I’ll break down their full card lineup, how the Preferred Rewards program can supercharge your earnings, the rules and quirks you need to know, and the unique perks that make BoA a serious contender.

Note: I also recorded a full podcast episode about the BoA line up on Ep #247 or you can watch the video version below.

🏆 Preferred Rewards

Before talking about Bank of America credit cards, I need to explain their Preferred Rewards program, because it is the single reason that I am so positive about Bank of America's cash back card lineup. At it's core it's a program that rewards customers who hold assets at Bank of America or Merrill Lynch (including checking, CDs, brokerage accounts, and retirement accounts). While it has many rewards, the only one relevant to this post is the multiplier it offers for all credit card earning (excluding co-brand cards like Alaska)

- Gold ($20k): +25%

- Platinum ($50k): +50%

- Platinum Honors ($100k) and Diamond ($1M+): +75%

That means that if you reach Platinum Honors and have the 1.5% Unlimited Cash card, it will become a 2.625% card (1.5% * 1.75). While I know $100k is not feasible for everyone, it is possible to meet this balance with a brokerage account, including retirement accounts like a Roth IRA. Once status is earned it's locked in for a year and while the balance is reviewed as the average balance over the last 3 months, new customers are eligible for a fast-track to earn status much faster.

Also if you maintain an eligible balance in a joint account, both joint account holders will receive the corresponding status. However personal preferred rewards status does not carryover to business accounts. To earn the multipliers for business cards, you'll need to qualify for preferred rewards with a balance in a business bank or brokerage account.

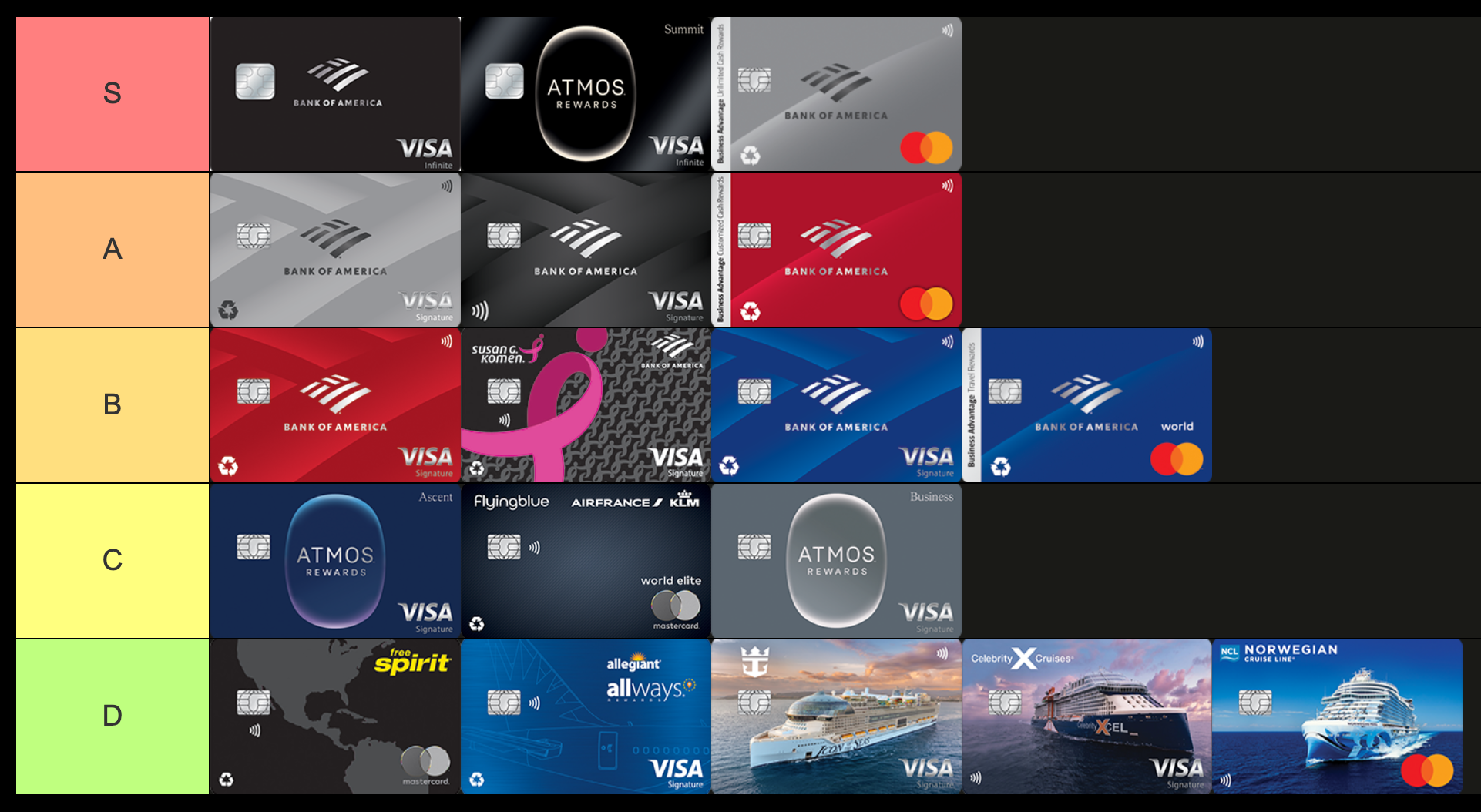

🥇 The BoA Cards Tier List

Here’s how I’d rank the Bank of America lineup, from the best of the best to the cards you can safely ignore.

S Tier – Top of the Pack

- Bank of America® Premium Rewards® Elite: My favorite card in the BoA lineup. Normally it earns 2% on travel/dining and 1.5% on everything else, but with Platinum Honors status, it earns 3.5% on travel/dining and 2.625% everywhere else. Even better, you get a a 25% uplift using your rewards to book flights, which would push it to an effect 4.375% on travel/dining and 3.28% on everything else. If you're eligible for Platinum Honors status, I think this is the best cash back card on the market.

- The Atmos™ Rewards Visa Summit Card: The best option for Atmos/Alaska flyers. Huge signup bonus, 25k annual companion fare, waived same-day change fees, elite status boost, and 3x dining/foreign spend.

- Bank of America® Business Advantage Unlimited Cash Rewards Mastercard®: One of the best business cash back cards available. With Platinum Honors for Business, it earns 2.625% cash back on everything, uncapped.

A Tier – Excellent Picks with a Few Caveats

- Bank of America® Unlimited Cash Rewards: A simple, no-fee card that earns 1.5% everywhere (2.625% with Platinum Honors).

- Bank of America® Premium Rewards®: Similar to the Elite version above it earns 2% on travel/dining and 1.5% on everything else (or 3.5% and 2.625% respectively with Platinum Honors). The main difference is that it's lacking some of the benefits and doesn't offer an uplift on rewards value booking flights.

- Bank of America® Business Advantage Customized Cash Rewards Mastercard®: Strong business card with 3% back in your chosen category (gas, office supply stores, travel, TV/telecom, business consulting) up to $50k/year. With Platinum Honors, it goes up to 5.25%.

B Tier – Good, But With Limits

- Bank of America® Customized Cash Rewards: Earns 3% in a chosen category (gas, online shopping, dining, travel, drug stores, or home improvement/furnishing), but capped at $10k/year. With Platinum Honors that’s 5.25%.

- Susan G. Komen® Customized Cash Rewards Visa®: Same as the Customized Cash above but earns some extra rewards that get donated to the Susan G. Komen foundation.

- Bank of America® Travel Rewards: Similar to the Unlimited Cash (earns 1.5% on everything and 2.625% with Platinum Honors).. except that rewards can only be redeemed against travel purchases.

- Bank of America® Business Advantage Travel Rewards World Mastercard®: Business version of the Travel Rewards, with the same earning/rewards.

C Tier – Niche Use or Limited Value

- The Atmos™ Rewards Ascent Visa Signature Card: The lower-fee Atmos card with fewer perks and weaker earning than the Summit.

- Air France KLM World Elite Mastercard: Only valuable if you’re chasing Flying Blue elite status.

- The Atmos™ Rewards Visa Business Card: Business version of the Alaska Ascent card

D Tier – Skip These

- Free Spirit® Travel More World Elite Mastercard®

- Allways Rewards Visa® Card

- Celebrity Cruises Visa Signature® Credit Card

- Royal Caribbean® Visa Signature® Credit Card

- Norwegian Cruise Line® World Mastercard® Credit Card

📋 Key BoA Rules to Know

Bank of America has its own set of rules and quirks you need to be aware of when applying.

🕒 Application Rules

- The 2-3-4 Rule: You can open a maximum of two cards every two months, three cards every 12 months, and four cards every 24 months.

- The 3-12 Rule (General): Similar to Chase 5/24, you are usually unlikely to be approved if you’ve opened three or more cards with any bank in the past 12 months.

- The 7-12 Rule (BoA Customer): If you have a Bank of America checking account, the rule relaxes to seven accounts opened in the past 12 months, giving you a much higher likelihood of approval.

- 5 Consumer Card Limit: You are limited to a maximum of five Consumer Bank of America cards.

- Combining Hard Inquiries: BoA often combines hard inquiries if you apply for multiple cards (personal and business) on the same day, or sometimes up to 30 days apart.

- 24 Month Rule: Some Bank of America cards require waiting 24 months after opening or canceling before reapplying, but the rule isn’t applied consistently and can vary by card and person.

🔐 Credit Limits

Bank of America is really generous with credit lines over time. Initial limits can be high ($20,000 to $30,000), and I’ve seen them increase up to $100,000 on some cards. You can call in every 90 days to request an increase, and often these increases are processed without a hard inquiry. Plus, can also reallocate credit between cards, though the process is a little slow.

🤩 BoA Perks and Deals

🏛️ Free Museum Access

I love this perk via the Museums on Us program, where you get free access to 235 museums across 41 states on the first full weekend of the month. This includes major institutions like the MET and MoMA in New York. The catch: you need a Bank of America or Merrill Lynch credit card or debit card for each person. A hack we’re looking into is getting free SafeBalance accounts/debit cards for our kids, which are often free for those under 25, so they can get in free too.

🤑 BankAmeriDeals

These are BoA’s card-linked offers which are mostly online and not as compelling as other portals like Rakuten. Sometimes you’ll find decent retail offers like 10% off at Uniqlo or Shake Shack, but mostly they're not interesting.

🔚 Final Thoughts: How BoA Stacks Up

Bank of America right now might have the best cash back card lineup out there. Assuming you can qualify for Platinum Honors status and get that 1.75x boost, the ability to earn 2.625% on everything (or and effective 3.282% using the Elite card's 25% flight bonus) is amazing. Not to mention BoA is very reasonable on limits and limit increases. The new Atmos Summit card is also awesome, offering unique high earning categories, great travel perks and a path to earning top tier Atmos status.

On the business side, getting an uncapped 2.625% cash back (with Business Platinum Honors) is the highest rate for for a business card that I'm aware of.

The biggest downside is that it’s hard to get any outsized value from their rewards because they don't have transferable points. That said, if you’re on team cash back and can qualify for Platinum Honors, you shouldn't be sleeping on BoA.

Editor’s Note: The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.